Gold investment courses you know as soon as you learn

The motivation behind the rise in gold price

The focus of this episode

- 1. Compared with physical gold, gold futures and London gold (spot gold)

- 2. The reason for gold pricing

- 3. What affects gold prices?

Gold has always played an important role in the international currency system. In different periods of history, all countries in the world have used gold as circulating currencies. The first gold coin in the world was cast around 560 BC. In the 15th century, the motivation to drive Portugal and Spain for colonial activities was to "grab gold". In addition, the discovery of gold mines in the 19th century in the United States has triggered the largest immigrants in American history ... Let's talk about the charm of gold.

- Looking back at the development history of gold

- Gold's supply and demand analysis: Key driving factor of gold price

- Why invest in gold?

- How to pricing gold?

- What are the related investment varieties of gold?

- Summary

For a long time, gold has been circulating as currency in many countries. Monetties in many countries in the world are linked to gold at a fixed price. Well, we also call this system as a gold -based.

In the 19th century, because the British at that time was in the dominant position in economic and politics, and Britain took the lead in adopting the golden -level system, it attracted the imitation of other countries. However, with the outbreak of the First World War, the international currency order fell into chaos, and the golden position became no longer applicable. After the war, the Great Depression made people lose confidence in banks and banknotes, and accumulation of gold was widespread. At this time, a new international system was urgently needed to replace the gold standard. As a result, the Bretton Forest system was born in 1944.

Under the Bretton Forest system, the exchange rate of the US dollar and gold is fixed at $ 35 per ounce, and the exchange rate of all other currencies to the US dollar is adjusted. However, in 1971, in order to deal with US inflation, President Nixon began to reduce the value of the US dollar against gold, but instead stimulated people to hoard more gold. In the end, Nixon completely decoupled the value of the US dollar with gold, which means that the Bretton Forest system officially ended.

Although the official status of gold in the international currency system is over, it is still an ideal investment product in people's hearts based on its scarcity and risk aversion attributes.

First of all, we start to introduce the basic situation of gold from the most basic supply and demand relationship.

- Production: According to the World Gold Association (WGC) data, the total amount of gold is equivalent to a 22 -meter cube so far. Since the California gold rush fever in 1848, more than 90%of gold in the world has been mined. It is said that in 2022, the three largest golden producers were China, Australia and Russia.

- Consumption: Since 2010, India and China have both the largest gold consumer countries. In addition, the United States, Saudi Arabia, Germany and Turkey are also gold consumer.

- Inventory: Gold is measured at weight. The United States has the world's largest gold reserves, weighs more than 8,000 tons, accounting for 4%of the 187,200 tons of gold that has so far.

We all know that gold is a scarce resource. It is precisely because the amount of gold is relatively limited that the price of gold is highly sensitive to changes in demand.

The information released by the World Gold Association (WGC) shows that the global gold ETF net outflow of about $ 1 billion in December 2023, recording net outflow for the seventh consecutive month, a total of 10 tons to 3225 tons. However, due to the rise in gold prices, the total scale of Global Gold ETF asset management rose by 1%to $ 214 billion. European funds recorded a net outflow of US $ 2 billion in December, and North American and Asian funds continued to buy gold. Among them, North American funds increased their holdings for the second consecutive month, with net inflow 717 million US dollars, while Asian Fund recorded net inflow 208 million US dollars, It is the ninth consecutive month to increase holdings of gold.

From the perspective of gold price, despite the significant resistance of the US dollar and the rising global interest rate, the price of gold in 2024 is still going up.

For some investors, investing in gold may not just look at the golden "appearance of beauty", but also values the ability of gold itself to resist inflation and risk, especially in the period of economic instability. In short, gold has the following advantages:

- 1. Wear/collection: People's preference for gold is based on the resistance of this metal, ductility, and "symbolizing richness". According to the World Gold Association, nearly half of all gold in today's mining has been made into jewelry, which is still the largest single purpose of gold.

- 2. Wealth preservation: Over time, inflation will reduce the "actual" value of the currency. For example, a cup of coffee that can be bought at $ 5 today may only buy a bottle of mineral water in more than ten years. Compared with currency, gold can always maintain its value. Therefore, investing in gold can make investors' wealth be exempted from inflation to some extent.

- 3. Aversion: The value of currency is affected by national interest rates and currency supply policies. During the period of economic and geopolitical fluctuations, the value of currency will fluctuate. Gold does not know, so gold has a hedging attribute.

- 4. Diversification of investment portfolios: Gold usually has low correlation with traditional financial assets such as stocks and bonds. Sometimes, the stock market fell due to high inflation and economic uncertainty, but holding gold but holding gold There may still be investment returns. Therefore, incorporating gold into the investment portfolio can balance the investment portfolio.

There are several different ways to invest in gold, depending on whether investors want to invest directly or invest in indirect ways.

-

1. Gold

First of all people may think of physical gold such as jewelry, gold bars, etc., yes, this is one of the simplest ways to invest in gold. In the past ten years, small gold bars and gold coins accounted for about half of the global gold demand.

-

2. Gold Futures

Gold Futures gives investors the right to purchase or sell gold on specific terms such as agreement prices in the future. It is a standardized contract for transactions on the regulatory exchange. Because many professional investors participate, the gold futures market usually has high liquidity and high efficiency. Investors can flexibly make more or short gold by buying gold futures. Therefore, gold futures are usually used by corporate customers for risk management purposes.

-

3. London Gold

Many people think that there is a gold in the world called London Gold. In fact, London gold is not the name of gold, but a spot gold trading contract based on London as a place of delivery. Hong Kong's London Gold Trading Campaign dates back to the 1970s, and the trading rules basically refer to the Golden Market in London.

London Gold is a spot gold trading contract. The product specifications refer to the standard of the London Gold and Silver Market Association (LBMA), which is a gold that is not less than 99.5%. Hong Kong's London Gold Trading Contract is 100 ounces per hand, and at least 0.1 hands or 10 ounces can be bought. The price of gold in London is determined by members designated by LBMA and is priced twice a day for USD/ounce. The Golden Trading Chamber of Hong Kong refers to the spot gold pricing of the London market, and then provides customers with sale and selling quotes based on the offer of other trading opponents in the market.

Different from buying and selling stocks and futures contracts. There is no trading venue in the London Golden Market. Overseas transactions are used, which will be directly negotiated by buyers and sellers to complete the transaction. Hong Kong London Gold is also traded on the venue transaction. Dealers generally launch orders for the market after receiving the purchase and sale orders from customers. Because it is over -the -counter, Hong Kong investors can buy and sell London Gold for almost 24 hours.

In fact, many investors have always been unable to know what the so -called "gold price" refers to, spot or futures price? Various prices of the gold market are flying all over the sky. Which is the most important?

The answer is not difficult. Let's first classify a simple golden price type!

-

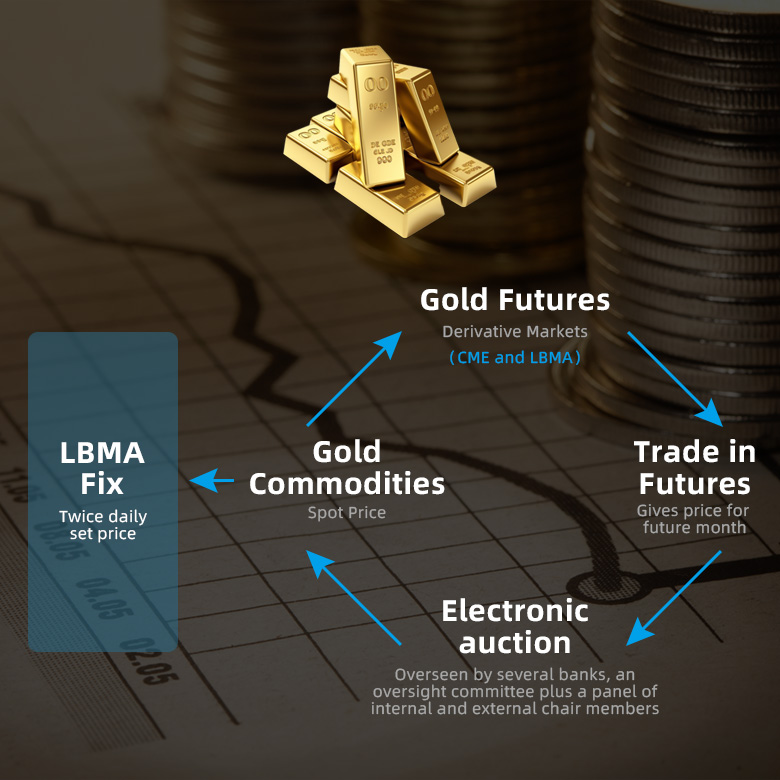

The price of gold is set through the following three ways:

- Spot: The price of gold bars is usually agreed based on the spot price of gold products. In other words, the price is determined by the market when purchasing, so it will change according to supply and demand.

- London Price: At the beginning of the last century, since London, England was the global gold trading center, local gold prices played a global guiding role. Five members of Dingpan Co., Ltd. have determined by the gold price determined by the conference call, which is used as the benchmark for pricing of major gold products and derivatives in the world.

The price of gold is a price agreed between the bank at a certain moment. The participants must be a member of the London Gold and Silver Market Association. Barclays Capital, Deutsche Bank, HSBC Bank and French Industrial Bank. The price of the golden market was announced in the morning and afternoon of London time in the trading day. As the development fixed price also includes the pricing of USD (USD), pound (GBP) and euro (EUR).

The price of gold is usually opened by the chairman of the conference at a gold price close to the spot market. Participants will then bid according to the customer's supply and demand until the price of gold is set.

The above pricing mechanism was replaced by the new LBMA gold pricing mechanism in 2015. The new pricing mechanism continues the arrangement of two fixed price prices twice a day. (IBA) is responsible for gathered transactions through the bidding of the Gold Bidding Electronic Platform. To this day, members participating in the pricing mechanism have increased to 15 institutions, including Bank of China, Bank of Communications, Citibank, Goldman Sachs, HSBC, and Industrial and Commercial Bank of China. - Futures contract price: Gold futures contract is a futures contract with gold bars as the target asset. The price is the agreed price of investors and suppliers to buy and sell gold on a specific date.

Gold trades 24 hours a global scale, usually denominated in US dollars. According to data from the World Gold Association, about 90%of the world's gold trading occurred on the London Overseas Trading Market or New York COMEX or Shanghai Gold Exchange. Among them, the trading volume of the global field trading (OTC) market was the largest. Therefore, the OTC market plays an important role in setting gold prices.

-

As a result, investors can pay attention to the indicators of three gold prices:

- Spot price: Gold spot price is the most common standard for measuring the current exchange rate of gold. It is calculated based on the gold balance ounce and changes every few seconds in the market trading time. The price of gold in gold is the basis for most gold bar dealers to determine the charging.

- LBMA Gold Price: The London market accounts for about 70%of the global nominal trading volume, and the London Gold and Silver Market Association (LBMA) is a global gold and silver market. It is the reference benchmark of the gold market. The price of LBMA gold is denominated in US dollars. There are two pricing opportunities every morning in the afternoon, which is operated and managed by the ICE Standards Administration (IBA).

- COMEX Gold Price: London plays a leading role in the physical market, but from the perspective of futures contracts, the world's largest real -time derivative market is Chicago Commercial Exchange (CME or COMEX) And New York Commercial Exchange.

The factors affecting the trend of gold in fact are actually inseparable from the logic of investment gold mentioned above. We summarize it as the following six factors.

| Affects gold price factor | Relative | Cause |

| Inflation | + | Rising prices will increase the value of gold. Therefore, theoretically increased demand for gold during inflation often increases gold prices. |

| US dollars | - | When gold is priced in the US dollar, when the US dollar appreciates, the price of gold itself will fall. |

| Monetary Policy | +/- | Due to the anti -inflation attributes of gold, when the Fed's interest rate hike suppressing inflation, the value of gold is also negatively affected. On the contrary, rate cuts are often good for gold. |

| Risk aversion demand | + | The value of currency in the period of economic and geopolitical fluctuations fluctuates, and purchasing gold can avoid risks to a certain extent. |

| Commodity requirements | + | When people's demand for jewelry rises, the price of gold usually rises. |

| Purchase of central banks | + | For the purpose of diversified reserves, risk management, and strengthening economic stability, a large number of purchases of central banks often raise gold prices. |

According to the several factors mentioned in the form, we specifically look at the two examples that affect the gold price:

FINANCIAL TIMES news reports said that inflation and currency depreciation triggered a wave of gold as a means of preservation. Therefore, emerging market central banks are buying gold in large numbers to seek dependence on the US dollar. Among them, the People's Bank of China has a record high globally, and Poland and Turkey are followed by.

In addition, the news of BNN BLOOMberg also mentioned that it was supported by the end of the US interest rate hike cycle, the purchase of central banks, and the support of a series of risk aversion needs. From July 2022 to July 2023, the price of gold rose 15% about.

If you feel that you have learned about gold from this course, you may wish to pay attention to the "advanced" column of our macro interpretation, and check the latest market data!